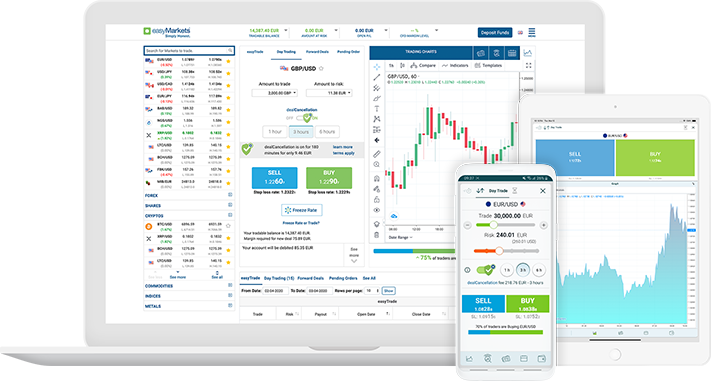

Through its real-time Forex trading platform, easyMarkets Australia offers complete suite of tool for Web, Desktop, Mobile and MT4 trading with 24 hours a day support and Dealing room service. In addition, easyMarkets provides One on One Forex training, The Trading School – Video on Demand trading lessons, and seminars.

Trade forex, Commodities, Indices, Vanilla Options on Our New Trading Platform

WHY TRADE WITH easyMarkets?

- Unique dealCancellation feature

- Guaranteed Stop-Loss Rate

- Competitive spreads

- No commissions

- Online trading with Live, real time quotes

- No software downloads

- Start trading within minutes

- easyTrade for automatic hedging

View Current Promotion

Open a Live Account

Open a Demo Account

Webinars & Events

easyMarkets Trading - Instant Activation

Our innovative trading platform requires no installation and is available for trading instantly, with one of the quickest trading activation processes in the industry. Start trading in minutes today.

Open a demo account to try our features, or open a live account to start trading in minutes.

Accounts Comparison

We design trading accounts for you

At easyMarkets we don’t just offer you an account, we offer you a complete trading experience. Our benefits and conditions have been developed over almost two decades of experience and were designed to cover each of your individual needs.

standard

- No Commission

- Competitive Spreads

- $50 dealCancellation Credit*

- FREE Guaranteed Stop Loss

- Negative Balance Protection

- 1st Trade Walkthrough

- Daily High Probability Trade Ideas

- Daily Analysis Access

premium

- No Commission

- Tighter Spreads

- $500 dealCancellation Credit*

- FREE Guaranteed Stop Loss

- Negative Balance Protection

- 1st Trade Risk Free Walkthrough

- Personal Dedicated Dealer Access

- Premium Trade Ideas & Daily Analysis

VIP

- No Commission

- Institutional Spreads & Rolling Fees

- Up to $2000 dealCancellation Credit*

- FREE Guaranteed Stop Loss

- Negative Balance Protection

- Personal Dedicated Dealer

- Daily Investment Bank Trading Reports

- VIP Market-Mover SMS Alerts

- Absolutely No Slippage On large Sizes

easyMarkets Pty Ltd (AFSL 246566 ABN 73107184510) makes no recommendations as to the merits of any financial product referred to in this website, emails or its related websites and the information contained does not take into account your personal objectives, financial situation and needs. We recommend that you read the Regulation Page, The Product Disclosure Statement, the Client Agreement and the Financial Services Guide before making any decision concerning easyMarkets products.

2024 © easyMarkets Pty Ltd (formerly known as easy forex Pty Ltd) ABN 73 107 184 510 and is regulated by the Australian Securities and Investments Commission (ASIC).

Australian Financial Service (AFS) Licence No. 246566.

Target Market Determination – OTC Options

Target Market Determination – Forward Contracts

Target Market Determination – CFDs

Target Market Determination – easyTrade